Planned Giving

- How to Give

- What to Give

- Barnes 1922 Legacy Society

- Gift Intention Form

- Donor Stories

- FAQs

- How Do We Use Your Gifts?

- Life Stage Gift Planner™

- Compare Gift Options

- Blog

- Request a Calculation

- Glossary

- Bequest Language

- Barnes Gift Acceptance Policy

- Contact Us

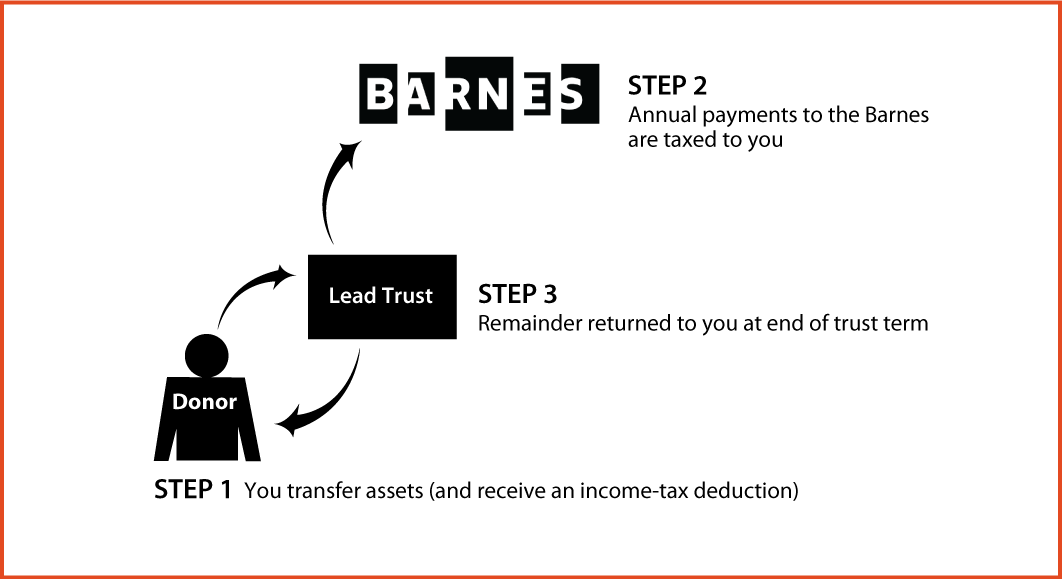

Grantor Lead Trust

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years), transfer cash or other property to trustee, and receive an income-tax deduction

- Trustee invests and manages trust assets and makes annual payments to the Barnes

- Remainder transferred back to you

Benefits

- Annual gift to the Barnes

- Property returned to donor at end of trust term

- Professional management of assets during term of trust

- Charitable income-tax deduction, but you are taxed on trust's annual income

More Information

Request an eBrochure

Request Calculation

Contact Us

Nina McN. Diefenbach Federal Tax ID Number: 23-6000149 |

The Barnes Foundation |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer