Planned Giving

- How to Give

- What to Give

- Barnes 1922 Legacy Society

- Gift Intention Form

- Donor Stories

- FAQs

- How Do We Use Your Gifts?

- Life Stage Gift Planner™

- Compare Gift Options

- Blog

- Request a Calculation

- Glossary

- Bequest Language

- Barnes Gift Acceptance Policy

- Contact Us

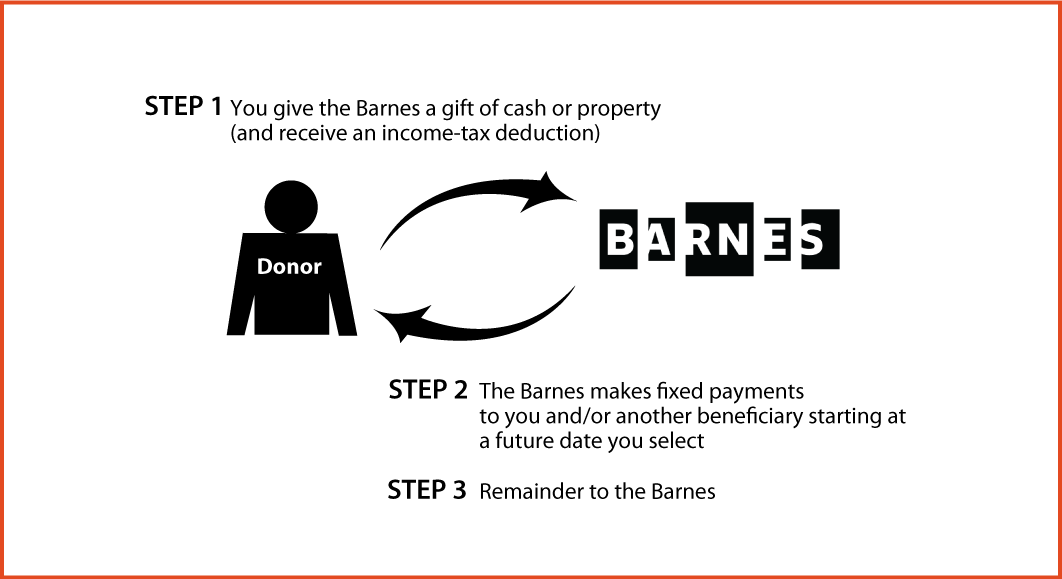

Deferred-Payment Gift Annuity

How It Works

- Transfer cash or other property to the Barnes

- The Barnes agrees to make payments for the life of one and up to two annuitants (payments are backed by our entire assets)

- The balance of the transfer inures to the Barnes

Benefits

- Payments for life that are favorably taxed

- When gift is funded with cash, part of payment will be tax-free

- When gift is funded with appreciated property, part will be taxed as capital gain, part will be tax-free, and part will be taxed as ordinary income

- Federal income-tax deduction for a portion of your gift

- Gift will provide generous support for the Barnes

The information contained herein is offered for general informational and educational purposes. The figures cited are accurate at the time of writing. State law may affect the results illustrated. This is not legal advice. Any prospective donor should seek the advice of a qualified estate and/or tax professional to determine the consequences of their gift. Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association. A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance.

More Information

Request an eBrochure

Request Calculation

Contact Us

Nina McN. Diefenbach Federal Tax ID Number: 23-6000149 |

The Barnes Foundation |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer